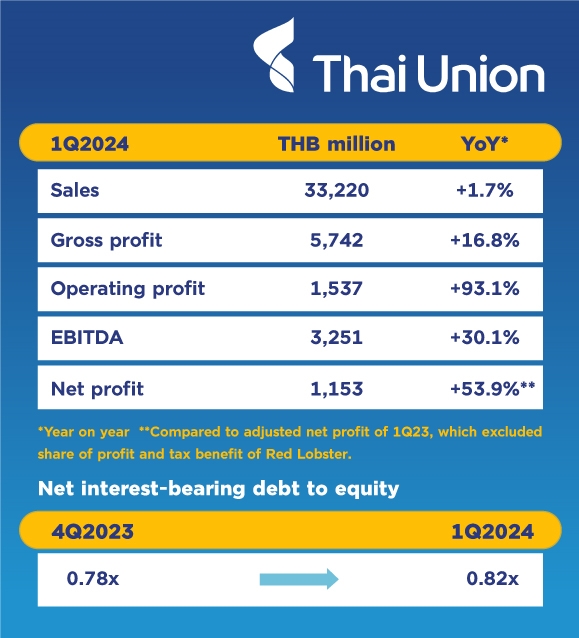

Thai Union records 1Q24 net profit of THB 1.2 billion as demand recovers across core product categories

- Net profit increased 53.9 percent from 1Q23 adjusted net profit to THB 1.2 billion due to a healthier operating profit

- Gross profit margin improved to 17.3 percent, with stronger GPM across Frozen, PetCare, and Value-added categories

- Sales increased 1.7 percent year-on-year to THB 33.2 billion

- Significant growth in PetCare business

BANGKOK - May 8, 2024 - Thai Union Group PCL reported a net profit of THB 1.2 billion in the first quarter of 2024, a 53.9 percent increase from the adjusted net profit of 1Q23, which excludes share of profit and tax benefits from Red Lobster. The strong result was driven by a robust recovery in demand across the core Ambient, PetCare, and Value-added categories.

Improved performances across all businesses helped lift sales by 1.7 percent in the first three months of the year to THB 33.2 billion from a year earlier. The Group’s gross profit margin improved to 17.3 percent, driven by Frozen, PetCare, and Value-added categories.

“Thai Union Group’s focus on our core business of Ambient, Frozen, and PetCare has been instrumental in returning our business to growth,” said Thiraphong Chansiri, CEO of Thai Union Group. “Our Group demonstrated great resilience during 2023 when we faced a challenging operating environment, and after seeing initial signs of a recovery in our performance in the final quarter of last year, I’m pleased to see that we have now emerged even stronger.”

In the first quarter, Ambient sales grew 12.7 percent year-on-year to THB 17.2 billion, with volumes rising 12.7 percent, resulting in an all time high sales contribution from Ambient, driven by stronger demand across all regions, particularly in the Middle East, Europe, and the U.S. The gross profit margin declined to 16.6 percent due to higher raw material prices in the Group’s inventory. PetCare sales increased 13.2 percent from a year earlier to THB 4.0 billion due to higher sales from the premium mix and price adjustment. PetCare delivered a gross profit margin of 25.7 percent, the highest level since the second quarter of 2022.

Sales in the Value-added category rose by 10.8 percent compared to the first quarter of 2023 due to improve product mix and booked a record-high gross profit margin of 29.5 percent. The Frozen category saw sales decline 17.7 percent year-on-year largely as a result of soft demand in the U.S. market and the implementation of the rightsizing strategy, which started in 2Q23. In terms of geographical diversity, sales in the U.S. and Canada accounted for 38.6 percent of total revenues, followed by 29.6 percent from Europe, 10.9 percent from Thailand, and 20.9 percent from others.

Net profit experienced a strong growth, compared to adjusted net profit of 1Q23. This was driven by improvements across all business categories, despite reduced foreign exchange gains, lower share of profit, higher financial costs, and increase of the tax expenses.

During the quarter, the Japan Credit Rating Agency, Ltd. (JCR) raised the Thai Union Group’s foreign currency issuer credit rating from A- to A with a stable outlook. This rating is the same level as the sovereign credit rating of Thailand from JCR.

Since the beginning of 2024, Thai Union announced its third share buyback program, in order to reward shareholders by returning excess capital to them and boost earnings per share. The share repurchase program will not exceed THB 3.6 billion or 200 million shares. At the end of March 2024, the total cumulative number of shares repurchased was 86 million shares, and Thai Union aims to continue repurchasing the shares in the remaining period of the program.

Thai Union’s commitment to sustainability remained a focus in the first quarter, announcing the Zero Wastewater Discharge Project at its fish plant in Thailand to set a new global benchmark for a seafood factory by achieving 100 percent wastewater recycling. The Group also launched the Shrimp Decarbonization initiative, developed in collaboration with global environmental organization The Nature Conservancy (TNC) and Ahold Delhaize USA, to reduce greenhouse gas (GHG) emissions within the shrimp supply chain, while Thai Union Feedmill became the first feedmill in Asia to receive the Aquaculture Stewardship Council (ASC) Feed Standard certificate, setting a new benchmark for sustainable feed production in the region.

“I am confident that through our Strategy 2030, which will create a sustainable and healthier future for humans, pets and the planet, and which is underpinned by a purpose of “Healthy Living, Healthy Oceans, that Thai Union Group is well positioned for sustained, long-term growth,” Chansiri said.

###

About Thai Union

Thai Union Group PCL is the world's seafood leader, bringing high quality, healthy, tasty and innovative seafood products to customers across the world for 47 years.

Today, Thai Union is regarded as one of the world's leading seafood producers and is one of the largest producers of shelf-stable tuna products with annual sales exceeding THB 136.2 billion (US$ 3,912 billion) and a global workforce of more than 44,000 people who are dedicated to pioneering sustainable, innovative seafood products.

The Company’s global brand portfolio includes market-leading international brands such as Chicken of the Sea, John West, Petit Navire, Parmentier, Mareblu, King Oscar, Hawesta, and Rügen Fisch, Thai-leading brands SEALECT, Fisho, Qfresh, Monori, OMG Meat, Bellotta and Marvo, and ingredient and supplement brands UniQ®BONE, UniQ®DHA and ZEAvita.

With a commitment to “Healthy Living, Healthy Oceans,” Thai Union is proud to be a member of the United Nations Global Compact, a founding participating company of the International Seafood Sustainability Foundation (ISSF), and current Chair of Seafood Business for Ocean Stewardship (SeaBOS).

Thai Union's ongoing leadership in sustainability has been taken to the next level with the announcement of SeaChange® 2030, the Company’s expanded sustainability strategy with more ambitious goals for people and planet. Through SeaChange®, the Company was recognized and listed on the Dow Jones Sustainability Indices (DJSI) for the 10th consecutive year in 2023, ranked number one on the Seafood Stewardship Index (SSI) for the third consecutive time, listed in the S&P Global Sustainability Yearbook 2024, achieved a B rating from global environmental disclosure non-profit CDP, and was also named to the FTSE4Good Emerging Index for the eighth straight year in 2023. Find out more about the Group’s sustainability strategy at https://www.seachangesustainability.org/