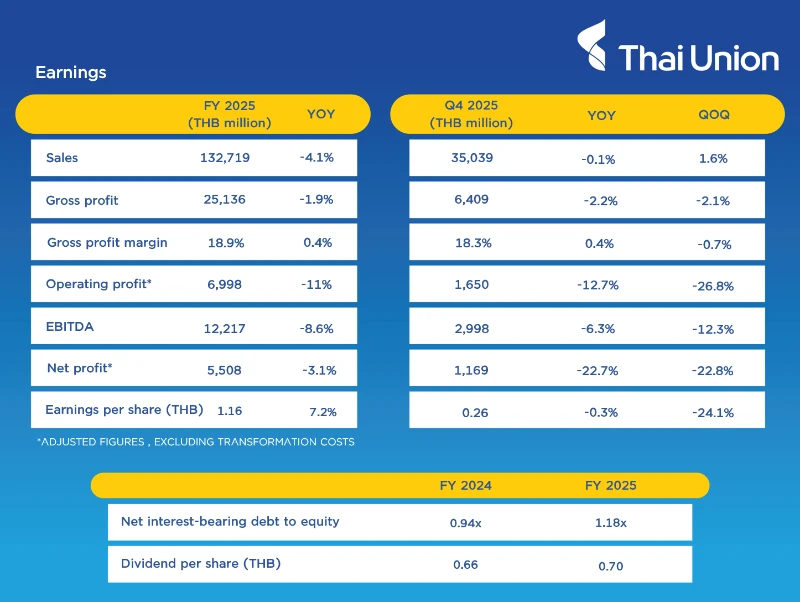

Thai Union’s gross profit margin for FY2025 reaches all time high of 18.9% with earnings per share growing by 7.2%

- Sales volumes grew to 908,000 metric tons following eight quarters of consecutive growth

- Full year sales were THB 133 billion with organic sales expanding in Q4 for the second straight quarter

- The total annual dividend grew 6% to THB 0.70 per share

BANGKOK – February 18, 2026 – Thai Union Group PCL (“Thai Union”) today announced its full year and fourth quarter 2025 results, delivering record profitability and demonstrating resilient execution in a challenging macroeconomic environment.

For 2025, Thai Union achieved a record gross profit margin of 18.9%, supported by stronger margins in its Frozen business, an improved business mix, and disciplined cost control. Margin performance was delivered despite U.S. tariff related cost pressures, reflecting effective pricing actions and the successful execution of major transformation initiatives.

Sales volumes for 2025 increased 2.5% to 908,000 metric tons driven by Ambient, Frozen and PetCare. Full-year sales reached THB 133 billion, while adjusted operating profit (excluding transformation costs) totaled THB 7 billion.

The Q4 2025 results confirmed Thai Union’s resilience. Excluding foreign exchange impact, organic sales grew for a second consecutive quarter at 0.7%, driven by solid volume growth in Frozen, Feed and PetCare.

The dividend payment for the second half of 2025 is THB 0.35 per share, bringing the total annual dividend to a very healthy THB 0.70 per share, representing a 6% increase compared to 2024 and a dividend payout of 57.7%.

Thai Union’s disciplined capital management supported improved per share outcomes in 2025, with earnings per share increasing 7.2% year on year, alongside continued share repurchases.

Thiraphong Chansiri, President and CEO of Thai Union Group, said, “2025 was a year of exceptional external headwinds, from tariffs to currency pressures, yet Thai Union remained resilient and achieved record gross profit margins, earnings per share growth, and constant progress on sales volumes. Importantly, the transformation we have already put in place allowed us to act as one global organization — moving faster, managing costs with discipline, and protecting margins even as cost pressures intensified. This execution under challenging conditions reinforces our confidence in the strength of our platform and our ability to perform consistently.”

Q4 2025 Business Category Performance

- Ambient: Volumes expanded in Europe, the U.S. & Canada, and Thailand but sales softened by 1.8% year-on-year due to lower average prices mainly in Europe.

- Frozen: Sales grew 3.4% year on year, with volumes up 5.6% year on year, driven by tariff related price adjustments and strong performance from the feed business. Gross profit margin in Frozen reached an all time high of 14.5%, supported by higher selling prices linked to U.S. tariffs.

- PetCare: Sales increased 1.4% year on year (or 6.7% year-on-year in USD terms), driven by a 2.8% volume increase, supported by higher demand from key customers, particularly in the U.S. and Europe. PetCare GPM improved year on year to 26.3%, exceeding the target range (23–25%) for the third consecutive quarter.

- Value-added: GPM was at a healthy 21.7% but sales were impacted by lower demand in the U.S.

Capital Management and Share Repurchase

The company completed its fourth buyback of 400 million shares in the first half of 2025, with a total value of THB 4.3 billion. It then reduced its registered capital by cancelling 200 million shares, effective 8 January 2026, bringing paid up capital to 4.2 billion shares.

Thai Union continued to prioritize shareholder value while preserving financial flexibility for future investments, consistent with its capital management strategy.

Sustainability Recognitions and ESG Leadership

In 2025, Thai Union further strengthened its ESG leadership and corporate reputation. The company’s FTSE Russell ESG score improved to 4.3 out of 5 (from 4.1), driven by stronger disclosures and performance across environmental, social supply chain and governance themes. Moreover, the company’s CDP rating improved from B to A, reflecting progress in decarbonization, responsible supply chains and ocean protection under SeaChange® 2030.

2026 Outlook

Looking ahead to 2026, Thai Union expects to deliver continued top‑line expansion and improved profitability, supported by easing FX headwinds, better operating leverage, and progress from ongoing transformation initiatives.

Thai Union is targeting sales growth of 3-4%, driven by organic expansion across all business categories (particularly in PetCare) and expectations of less negative FX impact compared to 2025. Profitability is expected to strengthen further, with gross profit margin guided at 19-20%, reflecting expected improvements in both the Ambient and Frozen categories.

Operating discipline will remain a focus. SG&A to sales is expected at 13.5–14.5%, incorporating the full‑year effect of U.S. tariffs and higher marketing investments to support branded‑product growth, while transformation programs completed in 2024-2025 will decrease SG&A costs significantly. The Cost Reset program will extend these initiatives into long-term cost discipline to deliver savings of USD 60 million in 2026.

These targets may need to be updated due to the dynamic trade environment, which Thai Union will continue to monitor closely. The company also reaffirmed its ongoing commitment to shareholder returns, maintaining a dividend payout ratio of at least 50%.

“Thai Union is entering 2026 from a position of greater strength and readiness,” Mr. Thiraphong said. “Our focus on innovation and sustainability continues to differentiate our portfolio, particularly in premium segments, where customers value quality, responsibility and long term partnerships. We believe we have built the right foundations to deliver sustainable growth in a today’s trade environment.”